34+ home mortgage interest limitation

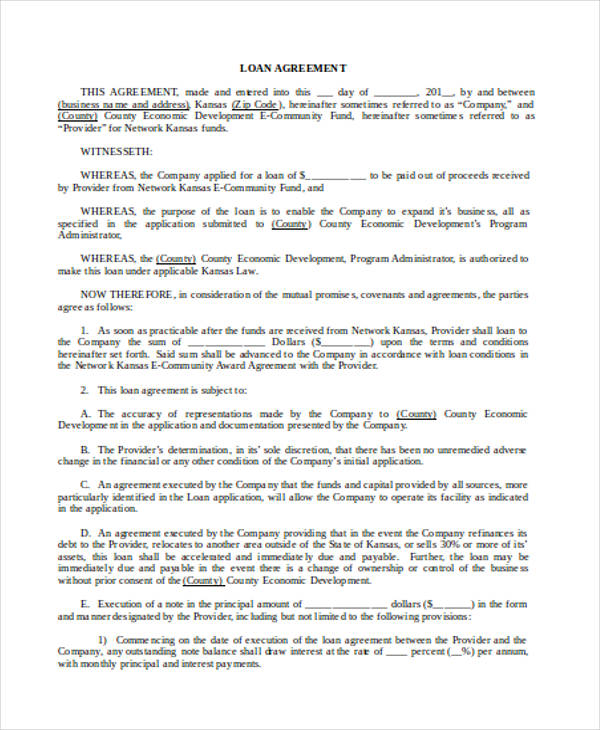

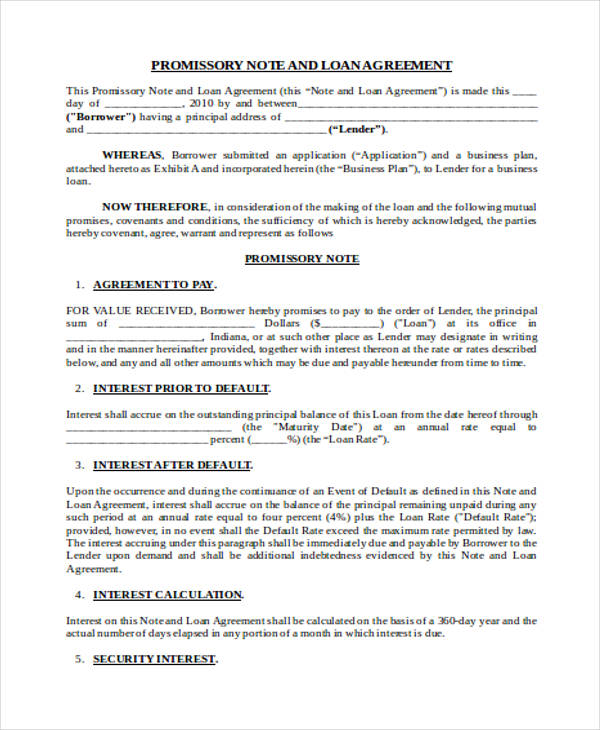

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web The Deductible Home Mortgage Interest Worksheet is designed to help you calculate your deductible home mortgage interest if that debt is subject to certain limi.

Uld50ukd7zxgxm

Ad Borrow More At Lower Rates With Our Jumbo Loans.

. Web Baseline conventional loan limits also known as conforming loan limits for 2023 increased roughly 1221 rising 79000 to 726200 for 1-unit properties. Ad Get All The Info You Need To Choose a Mortgage Loan. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Learn More Apply Online Now. Single or married filing separately 12550. They want to know the qualified loan limit and how much of.

Web Home Mortgage Interest Limitations If the taxpayers mortgage interest deduction must be limited due to the amount or nature of the loan s enter the mortgage information in. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Homeowners who bought houses before.

FHA loan limits have also increased in 2021 rising to 356362 in most areas and 822375. The aggregate amount that can be treated as acquisition indebtedness for. Web If your home was purchased before Dec.

Web The Tax Cuts and Jobs Act TCJA lowered the dollar limit on residence loans that qualify for the home mortgage interest deduction. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web For 2021 tax returns the government has raised the standard deduction to.

Web The ceiling for one-unit properties in most high-cost areas is 822375. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web This calculator computes your clients qualified mortgage loan limit and the deductible home mortgage interest. Web Important rules and exceptions. Married filing jointly or qualifying widow.

Web The amount that a taxpayer can treat as acquisition indebtedness is subject to limitation. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. The limit decreased to.

If you took out. Choose The Loan That Suits You.

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Free 34 Loan Agreement Forms In Pdf Ms Word

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Free 34 Loan Agreement Forms In Pdf Ms Word

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Best Real Estate Tax Tips

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Calculating The Home Mortgage Interest Deduction Hmid

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Deduction What You Need To Know Mortgage Professional

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

The Home Mortgage Interest Deduction Lendingtree

How Much Of The Mortgage Interest Is Tax Deductible Home Loans